Why

MSF Chula?

- Classes are taught by world-renowned experts in financial field: A-list faculty, visiting professors from world class universities, and active professionals in finance and banking sector

- Internationally recognized global learning

- Breakthrough curriculum to accelerate career in finance

- Opportunities to meet in persons with distinguished executives

- Flexible weekday or weekend schedules

- Accredited by EPAS as well as Chulalongkorn Business School’s AACSB and EQUIS

- Broad portfolio of learning opportunities at partner universities around the world

HIGHLIGHT

Together with EPAS, CBS has been accredited by EQUIS, which is an international program accreditation system developed by the European Foundation for Management Development (EFMD). There are currently merely 100+ institutions worldwide that has been awarded EQUIS accreditation, a very few of which are finance program.

EQUIS accreditation process involves an in-depth assessment of the Program through international benchmarking, considering an extensive range of factors that include the Program’s strategy; academic rigor; international focus; quality of the student body, faculty, alumni, as well as their career progression.

Chulalongkorn Business School and the program’s achievement of obtaining EQUIS accreditation reflects our commitment to continuous improvement and dedication to excellence in financial education. For more details regarding the accreditation of Chulalongkorn Business School, please refer to https://intl-accredit.acc.chula.ac.th

EXECUTIVE COMMITTEES

Assistant Professor of Finance

Associate Professor of Finance

Assistant Professor of Finance

Associate Professor of Finance

Assistant Professor of Finance

Assistant Professor of Finance

FACULTY MEMBERS

SUPPORTING STAFF

VISITING PROFESSORS

University of Innsbruck Austria

Smith School of Business, University of Maryland

Copenhagen Business Sochool, Denmark

School of Economics and Finance, Massey University, New Zealand

Bruno R. Gerard DNB Chair Professor in Asset Management, Norwegian School of Management, Norway | Christian C.P. Wolff Professor of Finance, University of Luxembourg, Luxembourg | Deborah Lucas Director of the MIT Golub Center for Finance and Policy, MIT Sloan School of Management, USA | Evangelos Vagenas-Nanos Senior Lecturer in Accounting and Finance, University of Glasgow, Scotland | Hendrik Bessembinder Professor of Finance, Arizona State University, USA | Keng Yu-Ho Professor of Finance, National Taiwan University, Taiwan | Marc Paolella Professor of Empirical Finance, University of Zurich, Switzerland | Meir Statman Glenn Klimek Professor of Finance, Santa Clara University, USA | Michael J. Aitken Professor of Finance, Macquarie University, Australia | Morten Bennedsen Professor of Economics, University of Copenhagen, Denmark | Paul Embrechts Professor of Mathematics, ETH Zurich, Switzerland | Roger King Professor of Finance, Hong Kong University of Science and Techonology (HKUST) | Shawn Cole Professor of Finance, Harvard Business School, USA | Söhnke M. Bartram Professor of Finance, University of Warwick, England | Tony Kang Professor of Accounting, University of Nebraska-Lincoln, USA | Vidhan Goyal Chair Professor of Finance, Hong Kong University of Science and Techonology (HKUST) | Donald R. Chambers Professor of Finance, Lafayette College, USA

ADJUNCT and CORPORATE CONNECTIONS

Sunti Tirapat Associate Professor of Finance, National Institute of Development Administration (NIDA) | Kridsda Nimmanunta Director of Professional MBA/MSc in Finanical Investment and Risk Management, National Institute of Development Administration (NIDA) | Nattawut Jenwittayaroje Director of the MSc in Financial Investment and Risk Management (MSc in FIRM) program, National Institute of Development Administration (NIDA) | Chonladet Khemarattana Chief Executive Officer, Fintech (Thailand) Co., Ltd. | Chatsularng Karnchanasai, The Bank of Thailand | Chattrin Laksanabunsong Head of 10X Project, Siam Commercial Bank | Kobsidthi Silpachai Head of Capital Markets Research, Kasikorn Bank | Kris Panijpan Managing Partner/Co-Founder, 9 Basil Co., Ltd. | Paritat Lerngutai Chief Financial Officer, Sri U-Thong Limited | Pasu Liptapanlop Director, Proud Real Estate Plc. | Pisit Jeungpraditphan Audit Committee Director & Independent Director, Mudman Public Company Limited | Ponladesh Poomimars, The Bank of Thailand | Sirinattha Techasiriwan | Somjin Sornpaisarn Chief Executive Officer, TMB Asset Management | Sopon Asawanuchit Managing Partner, Confidante Capital Co.,Ltd. | Sornchai Suneta First Vice President, Chief Investment Officer, Wealth Segment, Siam Commercial Bank | Waraporn Prapasirikul Partner, Ernst & Young Office Limited | Yunyong Thaicharoen First Executive Vice President, Economic Intelligence Center, Siam Commercial Bank | Yuttapon Wittayapanitchagorn Executive Vice President, Fixed Income Investment Group, Investment Division SCB Securities Company Limited

Alumni

The findings indicate that modern machine learning models significantly outperform the traditional logistic regression model in both the overall unsecured retail market and the subprime market. This superior performance is likely due to modern models' ability to capture various customer profile, non-linear relationships and interactions among variables, which are more prevalent in riskier subprime borrowers.

However, in the prime market segment, where borrowers tend to have more stable behaviors, modern models do not show a significant advantage over logistic regression. This is because the prime segment generally exhibits simpler, more linear patterns in the data, which logistic regression can model effectively without the need for more complex algorithms.

Although a Probit model was initially applied to estimate the likelihood of safe haven behavior, it was not pursued further due to a lack of variation in the dependent variable; most healthcare sectors did not exhibit safe haven characteristics, making the model statistically unviable. Accordingly, this study does not conclude that the healthcare sector served as a safe haven during COVID-19. However, the OLS regression suggests that certain pandemic-related factors—particularly strong government responses and lower death rates—may have contributed to a reduction in correlation between healthcare and market indices, especially in countries with effective public health infrastructure.

and ESG performance on corporate debt financing costs of the firms in Asia-Pacific countries during the year 2014 to 2023. Grounded in signaling and stakeholder theories, the analysis assesses whether lenders respond more to transparency or actual ESG implementation.

The findings show that ESG performance consistently has a stronger and more significant impact on reducing borrowing costs than ESG disclosure. In models including both variables, only ESG performance remains significant. Robustness checks using an ESG gap score reveal that in developed economies, firms with misaligned disclosure and performance are penalized, while in emerging economies,

visibility through disclosure is more favorably received.

Overall, the results emphasize that ESG performance plays a more critical role than disclosure in shaping debt financing outcomes, though its influence varies by institutional context.

These findings reveal the importance of Diversity, Inclusion, and People development (DIP) that enhances a firm’s value, both the combination and each dimension, even in the diverse economy context like Emerging Asia. Corporate governance and ownership structures matter, but their influence is not a universal amplifier of DIP initiatives. Instead, its moderating effect is different on each DIP dimension.

The findings reveal that only awards received by competitors significantly reduce a firm’s abnormal returns, supporting both the Asymmetric Information Theory and Social Comparison Theory. In contrast, the gross opening revenues of a firm’s own movies do not lead to abnormal returns, aligning with the Efficient Market Hypothesis, which suggests that investor expectations are already priced into the market.

(ESG) performance and corporate cash holdings among publicly listed firms in the Asia-Pacific region from 2010 to 2023. Grounded in stakeholder theory and the precautionary motive for cash, the analysis examines whether firms with higher ESG performance hold less cash and whether this relationship is moderated by financial constraints and financial distress. Employing panel fixed-effects regression, two-stage least squares (2SLS), and system GMM methods, the results consistently indicate that ESG performance is negatively associated with cash holdings. The moderating analyses reveal that financially constrained or distressed firms with high ESG

performance tend to retain more cash, highlighting the interplay between ESG and liquidity strategies. The study also shows that institutional quality strengthens the ESG–cash holding relationship. These findings contribute to the ESG-finance literature by offering region-specific insights from the Asia-Pacific, an underexplored and institutionally diverse region and provide practical implications for corporate financial policy and sustainability integration.

The analysis employs a panel regression model with firm and year fixed effects to test three main hypotheses. First, I examine whether corporate strategic aggression positively affects ESG scores. Second, I investigate potential non-linear relationships where excessive strategic aggression may lead to diminishing returns in ESG scores. Third, I analyze how institutional investor ownership moderates the strategic aggression-ESG relationship.

The findings reveal nuanced relationships between strategic aggression and ESG scores across different dimensions. Corporate strategic aggression demonstrates positive but statistically non-significant effect on overall ESG scores, positive and statistically significant effects on Environmental and Governance scores, while showing limited impact on Social performance. This provides partial support for the hypothesis that strategically aggressive firms achieve better ESG outcomes, particularly in environmental innovations and governance structures that align with their competitive strategies.

The study confirms a non-linear, inverted U-shaped relationship between strategic aggression and overall ESG scores, supporting the diminishing returns hypothesis. This indicates that while moderate levels of strategic aggression enhance ESG score, excessive aggression becomes counterproductive, particularly in social and governance dimensions.

Contrary to expectations, institutional ownership negatively moderates the relationship between strategic aggression and ESG performance. While both strategic aggression and institutional ownership independently contribute to better ESG scores, higher institutional ownership weakens rather than strengthens the positive impact of strategic aggression on ESG scores. This suggests that institutional investors serve as a restraining force on aggressive strategies, prioritizing long-term sustainable value creation over short-term competitive gains.

These findings contribute to the understanding of how corporate strategic choices influence sustainability performance and highlight the complex role of institutional investors in shaping ESG outcomes. The results have important implications for corporate managers seeking to balance aggressive growth strategies with ESG responsibilities, institutional investors considering their governance role, and regulators interested in enhancing corporate sustainability frameworks.

seen as the option market's prediction of how much the returns of the underlying asset will fluctuate in the future, over the remaining duration of the option.

If option markets operate efficiently, this implied volatility should serve as an

accurate and comprehensive forecast of future volatility. This means that implied

volatility should already incorporate all the relevant information available in the

market that could help predict future volatility; no other market variables should add

any further predictive power. This interpretation of implied volatility as an efficient

predictor of future volatility is widely used in various financial analyses.

Although the Black-Scholes implied volatility can be seen as a prediction of

future volatility, it can also be understood as a way to measure an option's price,

taking into account specific factors like how far the option is in or out of the money

and the time remaining until it expires. All existing option pricing theories agree that

option prices should rise and fall along with the volatility of the underlying asset. as

confirmed in Theorem 6 of Bergman et al. (1996).

Beside what has been studied in academic areas, It's widely observed in

options markets that implied volatility (IV) often surpasses realized volatility (RV).

This difference is usually explained by a few key factors.

Firstly, imbalances in the demand for and supply of options can play a

significant role. A strong demand for options from those looking to hedge against

risk, especially businesses and real money investors managing foreign exchange

exposure, can push option prices higher. On the other hand, the capacity of market

makers and financial institutions to sell options can be limited by regulations and risk

management rules.

Secondly, the risk aversion of market participants contributes to this

phenomenon. Essentially, people are willing to pay a premium to protect themselves

against extreme market events. This leads to a "volatility risk premium" built into

option prices, which is particularly noticeable in options with longer time horizons

and with deep out-of-money strikes.

The predictability of implied volatility and market efficiency remains an

ongoing area of research, raising questions about the potential for exploiting the

relationship between implied and realized volatility to generate consistent returns

through options trading strategies. To address this, we investigate whether mispricing

between implied volatility and realized volatility can be capitalized upon using an "at-the-money" (ATM) straddle strategy in the USD/THB currency options market. This

strategy, which involves simultaneously selling a call and a put option with the same strike price and expiration date, offers immediate premium income but carries the risk

of potential losses if the underlying asset's price experiences significant fluctuations.

The rationale behind can be simplified as higher Implied than realized volatility will

cause the options price to be overstated compared to its potential loss which can occur due to future movement of underlying asset. Hence, we will be selling overpriced options in our strategies.

Our study focuses on the USD/THB currency pair due to its importance in the

Thai economy and the prevalent use of USD/THB options for hedging purposes. We

hypothesize that implied volatility typically exceeds realized volatility in the

USD/THB options market, leading to inflated option premiums relative to the

potential payoffs from underlying asset price movements, and thus creating

opportunities for profitability.

In addition to the basic implied and realized volatility relationship, we

examine the profitability of other aspects of implied volatility, specifically the term

structure and volatility smile. Both of these phenomena are likely to incorporate

higher volatility risk premiums and irrational mispricing by the market, potentially

offering enhanced profitability compared to our base hypothesis.

Recognizing that selling and holding options until expiration without hedging

does not constitute a pure volatility play and can be influenced by scenarios of high

volatility with minimal price movement or low volatility with significant directional

price moves, we refine our analysis to include delta hedging. This involves daily

adjustments to the portfolio through the buying or selling of USD/THB forwards to

neutralize the delta exposure arising from the option positions, effectively isolating

the impact of volatility from underlying price movements.

By gaining a comprehensive understanding of the profitability of these

strategies, we aim to determine whether the observed returns are primarily driven by

mispricing between implied and realized volatility, as suspected. This will be

achieved through OLS regression analysis, examining the relationship between

strategy returns and explanatory factors. This analysis will include further

investigation of non-base strategies to define the drivers of each strategy's additional

return.

This paper will contribute to the deeper understanding of FX options trading

profitability, an area where existing research remains relatively underdeveloped,

particularly regarding the specific characteristics of options and the USD/THB

currency pair. The focus on USD/THB options is important given the growing FX

options market in Thailand. As Thai clients increasingly embrace complex financial

products for both hedging and investment purposes, this market offers significant

potential. Furthermore, FX options related products can offer more business opportunities compared to more established instruments like FX forwards and

traditional savings accounts. This research will enable service providers, such as

commercial banks, to better understand the profitability of their FX options offerings,

leading to optimized product design that benefits both the institutions and their

clients.

Among ESG pillars, the Social Score shows the strongest risk reducing effect. Additionally, ESG proves more effective in mitigating firm-specific risk during periods of economic crisis, such as the COVID-19 pandemic, China stock market crash and

the Russia–Ukraine conflict. Firms involved in ESG controversies tend to experience higher idiosyncratic risk, reinforcing the importance of transparency and stakeholder

trust. These findings highlight the financial value of ESG as a risk management tool in volatile, high-growth markets and offer practical implications for investors, firms, and policymakers across Emerging Asia.

The analysis uses monthly data from January 2017 to December 2023, covering both active equity funds and corporate bond funds. The models include fund level characteristics such as size, expense ratio, age, past flows, and return volatility, along with macroeconomic variables including inflation, exchange rates, interest rates, and industry sentiment.

The first result shows that AGP has a negative but statistically insignificant effect on fund flows for both active equity and corporate bond funds, although the direction is consistent with prior research only for equity funds. The second result reveals that fund’s βΔGP has a significant negative impact on future fund flows in active equity funds, implying that investors reduce capital allocation to funds that are more sensitive to economic risk, highlighting investor aversion to macro-sensitive strategies. In contrast, the relationship between fund’s βΔGP and fund flows is not statistically significant for corporate bond funds. Lastly, no significant interaction is found between βΔGP and periods of extreme market stress. Overall, while the influence of GP ratio is unobserved on corporate bond fund flows, its influence is notable in the case of equity funds with high βΔGP.

While average returns during the TOM period are consistently higher than those during the Rest-of-the-Month (ROM), none of the differences are statistically significant, suggesting a weak and inconsistent TOM effect. Further calendar-based tests during the Turn-of-the-Year (TOY), Turn-of-the-Quarter (TOQ), and Index Rebalancing (IR) windows also show no robust amplification of the TOM anomaly. Regression results on trading activity similarly reveal no statistically significant increase in volume during TOM periods, though trading by institutional and foreign investors appears directionally elevated in large-cap stocks.

These findings challenge prior evidence from developed markets and imply that the TOM effect in Thailand has weakened or become conditional on firm size and market structure. By integrating investor-type trading volume analysis, this study provides novel evidence that the TOM anomaly is not a persistent feature in Thailand’s increasingly efficient and institutionally influenced equity market.

Evidence in Thailand Equity Mutual Funds.

performance, persistence, and fund flows in the Thai mutual fund market. The

research focuses on three main objectives. First, it examines the relationship

between Morningstar ratings and performance metrics including net return, 1-factor

alpha, 4-factor alpha, Sharpe ratio, and Sortino ratio and risk metrics, including

maximum drawdown, standard deviation, and Value-at-Risk, using both matchedpair

analysis and regression methods. Second, it explores the persistence of fund

performance through quintile transition matrices, regression analysis of lagged 4-

factor alpha, and the cross-product ratio. Third, it analyzes the relationship between

Morningstar ratings and mutual fund flows by regressing fund flows on lagged

flows, ratings, performance, and ESG investment.

This paper finds that higher Morningstar ratings (3 to 5 stars) are

significantly associated with better fund performance. Highly rated funds tend to

deliver higher net returns, stronger alpha, and better risk-adjusted performance, while

also exhibiting lower risk. Based on this, one might expect consistent performance

over time, making investment decisions easier. However, the results in this paper also

show that during crisis the performance and rating persistence are exists but it is not

consistent in the long term. This implies that strong past performance does not

guarantee strong future performance. These findings are consistent with Carhart

(1997), who suggests that persistence is short-lived and tends to disappear over time.

Similarly, Elton, Gruber, and Blake (1996) find evidence of short-term persistence,

but not strong enough to indicate long-term outperformance. Regarding fund flows,

the results suggest that Morningstar ratings alone do not have a significant impact on

investor flows. Instead, fund flows are more strongly influenced by lagged flows,

past performance, fund characteristics (such as size, age, and expense ratio), and ESG

investment. This indicates that investors respond more to actual performance and

qualitative signals than to the rating label itself.

Governance (ESG) materiality issues on stock returns in the Stock Exchange of

Thailand (SET). Leveraging data from 90 listed companies between 2018 and 2021,

the research examines whether firms focusing on material ESG issues demonstrate

superior performance. Using an innovative SASB, MSCI, and MSCI-SASB ESG

materiality framework, the study differentiates between material and immaterial ESG

issues. By constructing portfolios based on ESG materiality scores and evaluating

their performance through a comprehensive five-factor model, the research provides

nuanced insights into ESG investing in an emerging market context. The study

addresses a critical gap in the existing literature by exploring ESG materiality's

impact in the Thai market, where unique market characteristics may influence the

relationship between sustainability factors and financial performance. Additionally,

the research analyses potential differences in stock returns between firms listed on

the Refinitiv ESG rating and those not included in the rating. The findings of this

study exhibit that different ESG materiality frameworks as well as portfolio

weighting methodologies provide different results on the relationship between ESG

materiality and stock returns in Thailand. As the equal-weighted portfolio exhibits

consistently higher volatility than the value-weighted portfolio. This research

contributes to the understanding of ESG materiality in emerging markets and offers

valuable implications for investors seeking to integrate ESG considerations into their

investment strategies.

volatility-managed strategies using Thai open-ended domestic equity funds from

January 2005 to December 2024. The study investigates whether volatility-managed

strategies improve risk-adjusted returns across both active and passive funds,

examines the performance drivers through volatility timing and return timing

analysis, and analyzes whether investors implement these strategies in practice

through fund flow behavior.

The results show that volatility-managed strategies improve risk-adjusted

performance and survive transaction costs but only work effectively during specific

market conditions. Thai mutual fund investors demonstrate awareness of volatility

timing benefits, as evidenced by reducing fund positions when volatility is high

across all volatility measures.

The result of this study finds that. First, it investigates the extent to which Thai REITs engage in dividend smoothing, finding that REITs in Thailand adjust dividends rapidly to align with their target dividend payout. Second, the results show that regulatory mandates by SEC—particularly the 2021 policy requiring REITs to distribute at least 90% of net income—positively influence dividend payouts, underscoring the importance of policy enforcement in promoting dividend discipline.

The results show that companies with high regulatory risk usually keep more cash because they expect extra costs from new rules. However, risks from natural disasters or moving to a low-carbon economy have less direct effect, because companies often use other ways like insurance or long-term plans to deal with them. The study also finds that when climate policy is more uncertain, companies save more cash to be safe. This was clear after big policy events, such as when the United States left the Paris Agreement.

Finally, the study shows that companies with financial problems have less ability to change how much cash they hold when they face climate risks. This means that strong financial health and clear government policies help companies get ready for climate challenges. This paper gives useful ideas for investors and policymakers and shows why stable and clear climate policies are important for business planning.

Results indicate a significant ESG yield spread in both corporate and government segments prior to the policy. However, while the spread remained unchanged for government bonds, it narrowed for corporate bonds after the policy launch, suggesting a potential shift in market dynamics. The findings highlight the importance of investor demand and policy design in shaping ESG bond pricing and offer practical insights for policymakers, issuers, and investors in promoting sustainable finance in emerging markets like Thailand.

The results show that board gender diversity is negatively and significantly associated with Tobin’s Q, indicating that increased female representation on boards is linked to lower market valuation. However, no significant effect is found on accounting-based performance measures, including ROA, ROE, and NPM. Additionally, internationalization is found to moderate the relationship between board gender diversity and profitability, with a significant interaction effect observed only for Net Profit Margin.

These findings suggest that while gender diversity may not enhance short-term financial performance or market perception in this context, it becomes more valuable in internationally engaged firms. The study contributes to the understanding of how board composition and strategic orientation interact to shape

has changed how the EU Emissions Trading System (EU ETS) responds to regulatory policy announcements affecting EUA supply and demand. Using event study and volatility analysis, it compares 81 events across Pre-MSR (before 2019) and Post-MSR (after 2019) periods.

Cumulative abnormal returns (CARs) are estimated via a mean-adjusted model and

tested using Welch’s t-test. Volatility is assessed through a GARCH(1,1) model, with structural differences evaluated using a Likelihood Ratio Test and a bootstrap test.

Findings show that the MSR has reduced overreaction and volatility in specific

contexts—particularly during recurring supply-related events like Auctions and MSR updates. CARs for MSR-related events improved significantly, and volatility persistence declined post-MSR.

While variance drops in individual categories were not statistically significant, patterns suggest improved market stability.

Overall, the MSR acts not only as a supply tool but also as a behavioral anchor,

strengthening market resilience where predictability and transparency are highest.

The findings reveal that Scope 1 emissions are positively and significantly associated with ROA, indicating that emission-intensive firms—especially in production-driven industries—may achieve higher profitability. Scope 2 and Scope 3 emissions do not exhibit significant effects on accounting-based performance, and corporate governance does not play a clear moderating role in this context.

However, in market-based performance analysis using Tobin’s Q, the winsorized results show that all emission scopes have a negative and statistically significant impact. Moreover, corporate governance is found to intensify this negative effect, suggesting that investors expect more from well-governed firms and may penalize them more severely for higher emissions.

This research offers valuable insights for regulators, policymakers, financial institutions, firms, and investors by highlighting the critical role of maturity mismatch. The findings may support to improved financial regulations and institutional frameworks, and enhanced corporate transparency, and greater investment awareness in the Thai capital market.

The findings reveal a U-shaped relationship between integrity and trade credit: only firms with exceptionally high integrity receive significantly more trade credit, while those with moderate levels do not experience a meaningful advantage. This positive effect disappears during periods of financial crisis but becomes more pronounced among firms with low market power. These results suggest that integrity may function as a strategic intangible asset—helping less powerful firms gain supplier trust in normal times, though its influence weakens when systemic risks dominate decision-making.

Using cross-sectional regression analysis with CAPM-adjusted abnormal returns, the study tests two hypotheses: (1) high excess volume during positive return months predicts negative future abnormal returns, and (2) high excess volume during negative return months predicts positive future abnormal returns. The empirical results provide statistically significant support for the second hypothesis (β = 0.613, p < 0.05), indicating that each unit increase in excess volume during market declines predicts a 61.3 basis point increase in next month's abnormal returns. However, the first hypothesis lacks statistical significance.

Portfolio analysis reveals that a trading strategy based on these findings generates positive raw returns (0.103% monthly) but exhibits high market exposure (beta = 1.018) with minimal risk-adjusted abnormal returns (Jensen's alpha = 0.064%). The strategy's adjusted R-squared of 0.653 indicates that portfolio performance is primarily driven by systematic market movements rather than superior stock selection.

The study documents pronounced seasonal effects, particularly significant underperformance in March (-105.3 basis points) followed by recovery in April (+96.8 basis points). These findings contribute to the literature by demonstrating that volume-based technical indicators can identify behavioral patterns in emerging markets, though practical implementation faces challenges from transaction costs and modest economic magnitude. The research provides empirical support for behavioral finance theories in a non-Western context while highlighting the asymmetric nature of volume-based signals in identifying oversold versus overbought conditions.

A regime-specific pairs trading strategy between SET50 futures and the TDEX ETF reveals persistent, regime-dependent arbitrage opportunities. Notably, one regime generates consistent net returns after transaction costs, although limited trade frequency raises robustness concerns.

The findings highlight the limitations of static models and underscore the value of adaptive, regime-aware strategies for exploiting arbitrage in futures markets for both regulatory policy designers and investors.

The results show that lottery stocks underperform other categories. Fama-Macbeth result supports that stocks classified as lottery exhibit lower returns in the subsequent month. The pair of lottery stocks held and not held by Thai mutual funds can generate positive alphas under both models on value-weighted basis, but the significances disappear under equal-weighted scheme suggesting exposure to size effects.

The analysis uses a sample of 66 matched pairs of green and conventional corporate bonds, matched through Propensity Score Matching (PSM) to ensure comparability across key bond characteristics. Key variables are obtained from Bloomberg for the period 2019 to 2024.

The results confirm the existence of a modest green bond premium, with green bonds trading at slightly lower yields than comparable conventional bonds, after controlling for liquidity differences. However, firm-level environmental performance does not have a statistically significant effect on the green premium. In addition, there is no evidence that social or governance performance moderates the relationship between environmental performance and green premium.

Further analysis reveals that the environmental, social, and governance pillars each independently contribute to mitigating mispricing, highlighting their distinct roles in enhancing pricing accuracy. ESG controversy does not significantly moderate the ESG - mispricing relationship. However, the interaction between ESG performance and analyst coverage is significant, implying that analyst coverage strengthens ESG’s effect on reducing mispricing. Analyst coverage alone also shows a strong negative association with mispricing, underscoring its role in enhancing market efficiency.

Further regression analysis reveals that financial variables influencing analyst’s forecasts include sales growth and return on equity (ROE). The results indicate that analysts tend to underestimate these variables, as they show a significance positive relationship with the returns of the portfolio bnased on analysts' forecasts. However, variables such as the number of analysts covering a company and the company’s operating cash flow (CFO) have a negative relationship with the returns of the portfolio based on analyst’s perspective, suggesting that analysts tend to overestimate these factors. On the other hand, investors tend to underestimate certain profitability indicators, such as gross profit margin and sales growth, which show a significantly positive relationship with the returns of the portfolio based on investors’ perspectives.

The findings reveal that while analyst consensus provides a general direction for investment decisions, its predictive power varies based on institutional ownership, consumer confidence, and unemployment rates. Institutional ownership appears to enhance the accuracy of recommendations, while macroeconomic factors such as consumer confidence and unemployment have mixed effects on returns. The results suggest that relying solely on analyst consensus may not guarantee superior returns, emphasizing the need to consider broader market conditions. These insights provide valuable implications for investors, financial analysts, and policymakers in understanding the dynamics of analyst recommendations in an emerging market context.

The findings indicate that carbon emissions do not significantly impact stock prices, suggesting that Thailand’s market may not fully price carbon risk. These results align with previous studies in other emerging markets, which highlight weaker investor sensitivity to carbon risk compared to developed economies. The study provides insights for investors, policymakers, and corporate managers regarding the evolving role of carbon emissions in financial decision-making.

The study also examines the role of bank-specific factors in moderating the effects of QE. Findings suggest that larger banks are less vulnerable to QE-induced risk-taking compared to smaller banks, particularly in emerging markets where regulatory oversight is weaker. Additionally, banks with higher loan-to-deposit ratios (LDR) exhibit mixed responses to QE, with those in advanced economies experiencing improved stability, while those in emerging markets face heightened risks. The relationship between QE and non-performing loan (NPL) ratios also appears non-linear, as QE initially improves financial stability for banks with high NPLs but may encourage excessive risk-taking in the long run.

These findings contribute to the ongoing debate on the effectiveness of QE, highlighting its unintended consequences on financial stability. The study offers important policy implications, suggesting that while QE can provide short-term liquidity benefits, regulators must implement macroprudential policies to mitigate excessive risk-taking, especially among smaller banks and in emerging markets.

Further analyses are conducted to examine how country specific factors such as Corruption Perceptions Index (CPI) and GDP per capita influence the relationship between ESG factors and CFP. Our findings discovered that there is a positive relationship between higher ESG performance against CFP. While the institutional quality of the countries proxied by CPI and GDP per capita were initially expected to have a moderating impact on the relationship between ESG performance and CFP, our results were contrary to the expectations. In our results, the positive impact of ESG factors on CFP did not appear stronger in countries with higher CPI Index (indicating lower corruption). Similarly, the positive effect of ESG factors on CFP was not stronger in countries with higher GDP per capita.

The findings indicate that geographic dispersion and intangible assets increase cash holdings, affirming Pecking Order Theory. Conversely, their interaction unexpectedly reduces cash holdings, suggesting that complexities prompt more conservative liquidity management. Also, increased managerial ownership results in lower cash holdings, supporting Agency Theory. However, the study could not explore non-linear effects of managerial ownership due to data limitations. While geographic dispersion increases cash holdings, higher managerial ownership can offset this effect, offering new insights into liquidity management in SEA MNCs.

The results of this study suggest that the spread between government bond indices with maturities of 3 to 7 years and 7 to 10 year, to 10 years and over 10 years and the widely-used 2-10 year spread are statistically significant in generating positive alpha and gamma values, confirming their effectiveness in market timing and their utility in enhancing investment strategies by predicting future market downturns.

Globally, sustainability ratings have a significant impact on mutual fund flows. This study finds that there is a strong initial impact following the publication of the Morningstar Sustainability Ratings, particularly for high ESG-rated funds, which attract substantial fund flows. However, this effect wanes over time. Additionally, the influence of sustainability ratings on Thai mutual fund flows during the COVID-19 pandemic suggests a "flight to quality," with investors prioritizing high sustainability rating funds over performance of funds.

The findings of this study demonstrate that certain factors in the single predictive model can outperform the historical MRP in these four countries, providing significant evidence for the emerging market, as this result aligns with previous studies. The study reveals that the AR (4) model outperforms both single and combined regression models in most countries, offering more accurate short-term forecasts of MRP. This result is consistent with prior research suggesting that simpler time-series models can be more effective for short-term predictions.

The study's novel approach, focusing on emerging Asian markets, contributes to the existing literature by highlighting the unique dynamics in these regions compared to developed markets. The insights provided are valuable for investors and policymakers in emerging markets, offering a more nuanced understanding of MRP predictability and aiding in more informed investment decisions. When comparing the combined regression model to the single regression model, the results generally support the hypothesis that the combined model outperforms individual factor predictions in single regression models.

I determined that however, on average, fund managers tend to generate negative alphas for their investors, there is a significant positive relationship between female, less experienced, and/or CFA-designated fund managers and risk-adjusted performance, which supports the behavioral finance as the overconfidence and too risky managed portfolio of male fund managers, the survivorship in the mutual fund industry for the less experienced fund manager which needs to work harder than more experienced fund manager, and more knowledge in the investment management industry to obtain the CFA designation. Regarding the fund performance persistence, the 12-month performance persistence mainly occurs in most characteristics, except the female manager’s fund. For 24-month performance persistence, the persistence more explicitly exists in males, with longer working experience, and/or non-CFA designated manager’s fund.

The findings reveal that high-loss stocks tend to rebound, supporting the underpricing phenomena, while high-gain stocks often continue to perform well, challenging the overpricing phenomena. The study shows that underpricing is negatively related to capital gains overhang, and investor sentiment significantly affects stock returns following extreme price movements. These results provide valuable insights into market dynamics, offering practical implications for investors, policymakers, and researchers in understanding and navigating Thailand's stock market.

The analysis reveals that Thai mutual funds generally avoid lottery-like stocks characterized by high skewness. However, this research finds during periods of low sentiment, small funds and more experienced funds show reduced aversion to these stocks, suggesting a strategic flexibility. Despite this shift, significant excess returns are not achieved, indicating that the strategic adjustments made by small funds and more experienced funds during periods of low sentiment do not influence on substantial financial gains.

Furthermore, the study highlights the moderating effects of Asset Tangibility, WUI, and Control of Corruption. Asset Tangibility helps firms secure loans more easily and at lower costs even amid high public debt levels, suggesting policies promoting asset investment can buffer the negative effects of public debt. Effective control of corruption reduces financial risks and mitigates the financial burden imposed by public debt on corporations, emphasizing the importance of anti-corruption measures. High levels of economic policy uncertainty, as measured by the WUI, discourage investment, indicating the need for clear and stable economic policies to enhance investment even in the face of high public debt. These insights emphasize the importance of good governance, asset investment, and stability in economic policies to support sustainable growth and development.

Drawing on the context of Thailand, where regulatory requirements mandate the involvement of FAs separate from UWs, this study investigates the impact of reputable FAs on IPO pricing. The research highlights the differing incentives and responsibilities of FAs and UWs, with FAs being more aligned with issuers' interests due to their fee-based compensation and ongoing advisory roles. Conversely, UWs may favor investors to secure future business, potentially leading to higher underpricing.

Through a detailed examination of the Thai IPO market, where FAs play a significant role throughout the listing process, this study provides insights into how FAs influence IPO outcomes. The findings suggest that distinguishing between the roles of FAs and UWs can enhance our understanding of IPO pricing mechanisms and offer practical implications for issuers aiming to optimize their IPO strategies.

In financial markets, the relationship between institutional ownership and stock returns has been a subject of extensive debate. Institutional investors, including mutual funds, pension funds, and hedge funds, wield significant influence over equity markets due to their holdings' sheer magnitude and ability to execute large-scale trades. Understanding how their investment decisions impact stock returns is not only crucial for investors seeking to optimize their portfolios but also for policymakers and market regulators aiming to maintain the integrity and efficiency of financial markets.

Although a large body of literature has studied the behavior of institutional trading and its impact on asset prices and returns, the investment horizon of institutional investors remains an open question.

Previously, several studies have shown that institutional investors have more information than individual investors, Yan and Zhang (2009); Puckett and Yan (2011); PÁStor et al. (2017) show that, while short-term institutions’ trades positively predict future stock returns, long-term institutions’ trades do not have any predictive power.

However, Gompers and Metrick (2001) state that two forces may be driving the positive relationship between institutional ownership and future returns: institutions either provide persistent demand shocks or they have an informational advantage. Yan and Zhang (2019) found that they have an informational advantage, and it is short-term institutional investors.

This result suggests that, if an institutional investor has an informational advantage over a group of stocks, it will exploit this advantage by actively and frequently trading these stocks to the limits such that there are no further gains. This is consistent with the notion that short-term institutions’ active and frequent trading (to exploit their informational advantage) contribute to their trades being more informed compared to the rest of other institutional investors’ trades.

The investment horizon denotes the timeframe over which institutional investors intend to hold a particular stock, ranging from short-term trading to long-term buy-and-hold strategies. Concurrently, the information possessed by institutional investors encompasses a spectrum of insights derived from various sources, including financial reports, industry research, and privileged access to corporate executives.

The relationship between institutional ownership and stock returns is a topic of significant interest and contention within the field of finance. While institutional investors play a pivotal role in shaping market dynamics, the precise mechanisms through which their ownership affects stock returns remain incompletely understood. This lack of clarity poses a critical challenge for investors seeking to optimize their portfolio allocations and policymakers striving to maintain market efficiency and integrity.

GLOBAL LEARNING

WORKSHOPS AND TALKS

STUDENT ACTIVITIES

1 year work experience

1 year work experience

PROGRAM

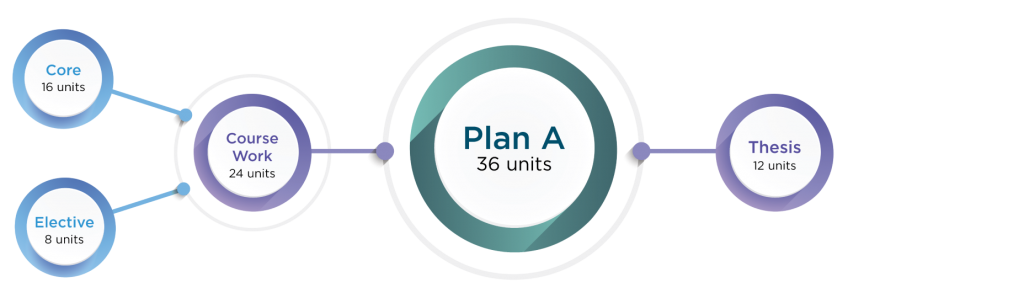

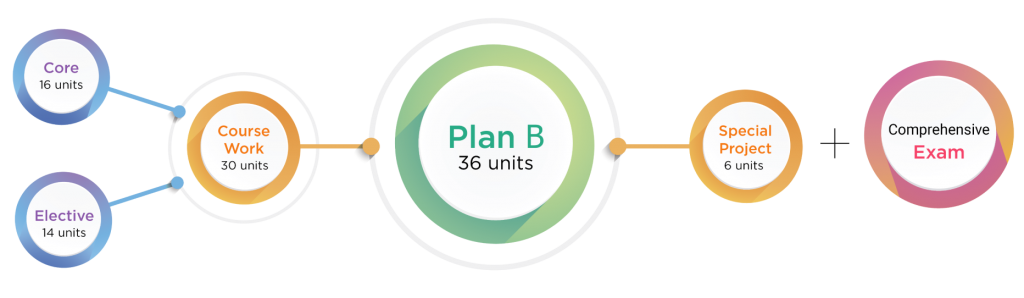

| Term 1 (August-November) |

Term 2 (December-March) |

Term 3 (April-July) |

|

|---|---|---|---|

| Plan A (Thesis) |

5 Core Courses | 1 Core Courses +3 Elective Courses +Proposal | 1 Elective Course +Thesis |

| Plan B (Special Project) |

5 Core Courses | 1 Core Courses +3 Elective Courses+SP(l) | 4 Elective Courses + SP(ll) + Comprehensive Exam |

Plan B: Students with at least 1 year work experience

PROGRAM

| Term 1 (August-November) |

Term 2 (December-March) |

Term 3 (April-July) |

|

|---|---|---|---|

| YEAR 1 | 3 Core Courses | 2 Core Courses | 1 Core Course + 2 Electives Courses |

| Term 4 (August-November) |

Term 5 (December-March) |

Term 6 (April-July) |

|

|---|---|---|---|

| YEAR 2 | 2 Electives Courses+ Comprehensive Exam | 2 Elective Courses +SP(l) | 1 Elective Course +SP(ll) |

Course List

- MANDATORY

- ELECTIVE: Corporate Finance

- ELECTIVE: Risk Management

- ELECTIVE: Investment

- ELECTIVE: Others

types and roles of various financial institutions in intermediation process; determination of interest rates; roles of regulators;

central banks; commercial banks; money supply process; debt markets; equity markets; foreign exchange markets;

financial instruments; efficient market hypothesis; financial markets in international context.

Condition: Prerequisite 2604631 and 2604632"

Financial planning and assessment of financing needs; cost of capital estimation and capital budgeting; discounted cash flow valuation model; weighted average cost of capital; adjusted present value model; corporate financial decisions and their impact on firm valuation"

Condition: Prerequisite 2604643"

Fundamentals of pension plans; pension plan valuation concepts; pension funding concepts; solvency concepts; asset and liabilities management of pension funds; optimal asset allocation and risk management for pension plans; capital requirements and economic capital."

With proficient professors and interesting curriculum, a year spent in this program was a great opportunity for accelerating my career path in finance."

UNIVERSITY FACILITIES

FACULTY FACILITIES

OPEN FOR APPLICATION 2025 - Admission

13 May 2026 (Approx 17:00 - 20:00) (Flexible)